BUSINESS LOAN

Business loans provide the financial assistance that companies need for various reasons, such as:

START UP LOAN

QUALIFICATION (REQUIRED)

- Only SDN BHD companies are eligible to apply.

- Annual revenue/sales exceeding RM 500,000.

- The company reported a profit in 2019.

- Director’s payment records for the last 6 months must not show more than 1 month of late payment.

- Company payment records for the last 6 months must not show more than 1 month of late payment.

- If the company’s financial year extends beyond December 31, 2018, the latest auditor’s report for 2019 is required.

CUSTOMIZED LOAN

Expand your business with a customized financing package designed specifically to help you grow.

10 THINGS THE BANK WILL ASK WHEN YOU

F.A.Q.

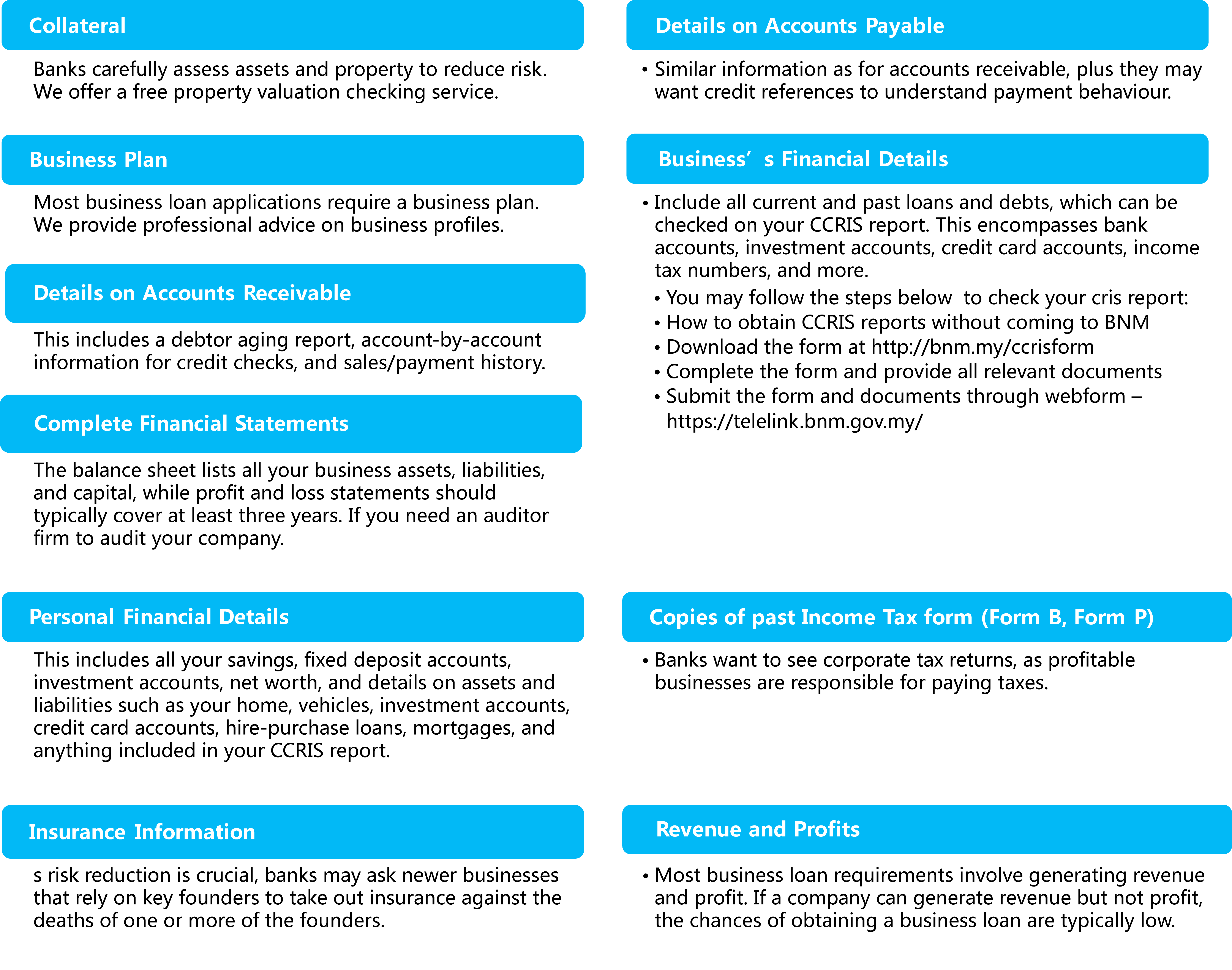

1. Collateral

As I explained above, banks do lend money to startups. One exception to the rule is that the government agency has programs that guarantee some portion of startup costs for new businesses so banks can lend them money with the government, reducing the banks’ risk.

So your business has to have hard assets/ property it can pledge to back up a business loan. Banks look very carefully at these assets/property to make sure they reduce the risk. For example, when you pledge Accounts Receivable to support a business loan, the bank will check the major receivables accounts to make sure those companies are solvent and they will accept only a portion, often 50 or sometimes 75%, of receivables to back a loan. When you get some working capital, the bank will accept only a percentage of the your assest/property market value and they check with multiple valuer, to make sure the standard market value is obtained.

The need for collateral also means that most small business owners have to pledge personal assets, usually house equity, to get a business loan.

We offer free service for property valuation checking, click here to find out more.

2. Business plan

There are exceptions, but the vast majority of business loan applications require a business plan document. Nowadays it can be short perhaps even a company profile but banks still want that standard summary of company, product, market, team, and financials. We offer professional advised on business profile, contact us

3. All of your business’s financial details

That includes all current and past loans and debts incurred, you can check on the CCRIS report, all bank accounts, investment accounts, credit card accounts, and of course, supporting information including income tax numbers. All this information is important for applying for a business loan.

How to check your ccris report click here * link to check ccris report You may follow the steps below

How to obtain CCRIS reports without coming to BNM

- Download the form at http://bnm.my/ccrisform

- Complete the form and provide all relevant documents

- Submit the form and documents through webform – https://telelink.bnm.gov.my/

4. Complete details on Accounts Receivable

That includes debtor aging report, account by account information (for checking their credit), and sales and payment history.

5. Complete details on Accounts Payable

That includes most of the same information as for Accounts Receivable and, in addition, they’ll want credit references, companies that sell to your business on account that can understand for your payment behavior. If you need to know more about Accounts Payable, can check with your accountant if don’t have any yet click here, we will get an accountant to assist you.

6. Complete financial statements, preferably audited or reviewed

The balance sheet has to list all your business assets, liabilities and capital, and the latest balance sheet is the most important. Your Profit and Loss statements should normally go back at least three years, but exceptions can be made, occasionally, if you don’t have enough history, but you do have good credit and assets to pledge as collateral. You’ll also have to supply as much profit and loss history as you have, up to three years back.

Regarding audited statements, having “audited” statements means you’ve paid a few thousand ringgit to have a Certified Public Accountant ,CPA go over them and take some formal responsibility for their accuracy. CPAs get sued over bad audits. The bigger your business, the more likely you’ll have audited statements ready as part of the normal course of business for reasons related to ownership and reporting responsibilities.

Click here if you are looking for auditor firm to audit your company.

7. All of your personal financial details

This includes all your savings, Fix deposit account or investment account, net worth, details on assets and liabilities such as your home, vehicles, investment accounts, credit card accounts, hire purchase loans, mortgages, the whole thing that has in your ccris report. For businesses with multiple owners, or partnerships, the bank will want financial statements from all of the owners who have significant shares. The owner will expect to sign a personal guarantee as part of the loan process.

8. Insurance information

Since it’s all about reducing the risks, banks will often ask newer businesses that depend on the key founders to take out insurance against the deaths of one or more of the founders. And the fine print can direct the payout on death to go to the bank first, to pay off the loan.

9. Copies of past Income Tax form (Form B, Form P)

Banks want to see the corporate tax returns as well caused if the business is profitable then the company is responsible to pay for the taxes.

10. Revenue and Profits

Most business loan requirement is business need to generate revenue and profit. If in the situation where the company can generate revenue but not profit, then the chances to obtain the business loan is very low. Talk to your accountant to rectify this issue. There are many thing you may outsourced it out to lower your company cost and increase efficiency.

In some situation you may not have 10 out of 10 to meet the loan requirement, consult us today for solutions. Need help finding a loan? Click here loan application inquiry.

|

FOR ANY ENQUIRIES, PLEASE CONTACT US. |

Speak to consultant

Speak to consultant